There is a second winter storm that will be working its way across the country the remainder of the week. Many areas already experiencing above average snow and ice conditions are anticipated to receive even more over the coming days.

Updated on: Feb 18, 2021

Second Winter Storm to Slam Texas - Videos from The Weather Channel | weather.com

As a result of the severe weather we are being informed of delays across multiple modes including TL , IMDL, LTL, etc.

LTL:

Terminal closures are prominent in Texas, Arkansas, Mississippi, Alabama, Tennessee, and Kentucky with operational delays impacting Illinois, Indiana, Ohio, and Michigan. Another artic storm is currently affecting Washington, Oregon, and Idaho. We expect operational delays to continue throughout the Central and Eastern U.S. through the majority of the week.

We hope your teams are staying safe and warm. We will continue to pass along updates as we gather them.

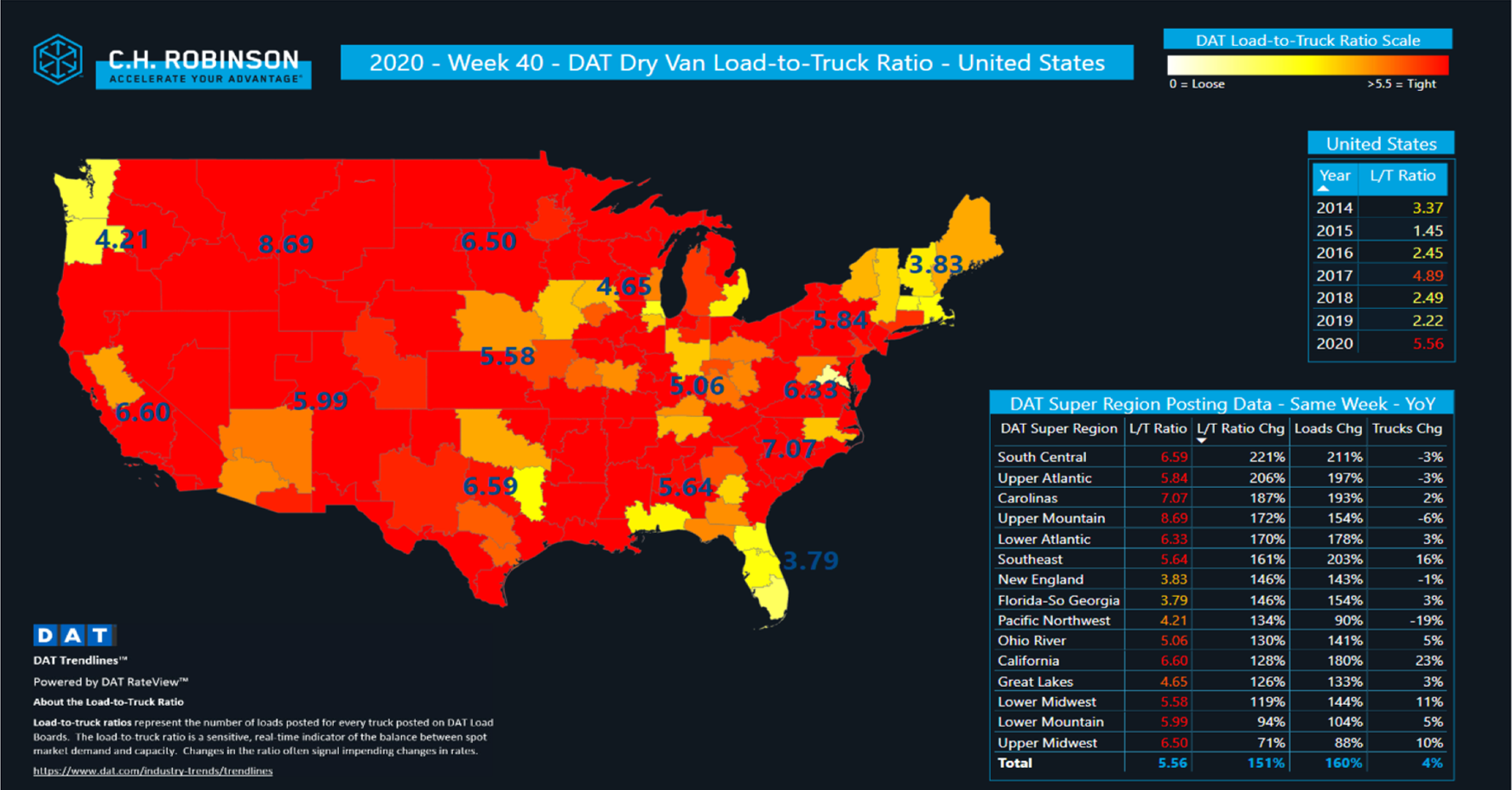

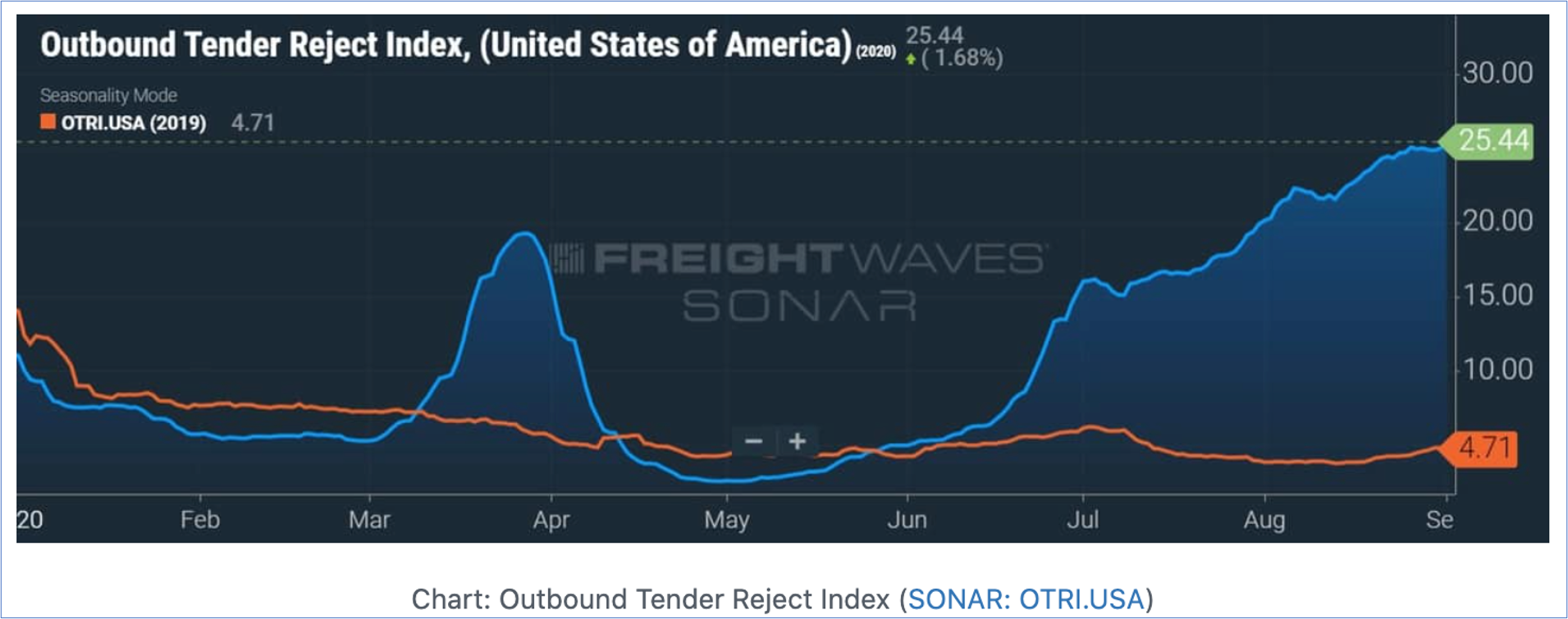

Tender rejection rates — the rate at which carriers reject electronically tendered load requests from shippers — have been a strong leading indicator in the past on what happens to contracted rates in the future.

The OTRR remains historically high above 25% indicating that one in four loads is being rejected at their current rates across the country

The survey captures the rate of change in activity for key supply chain trends in areas like transportation, inventory and warehousing.

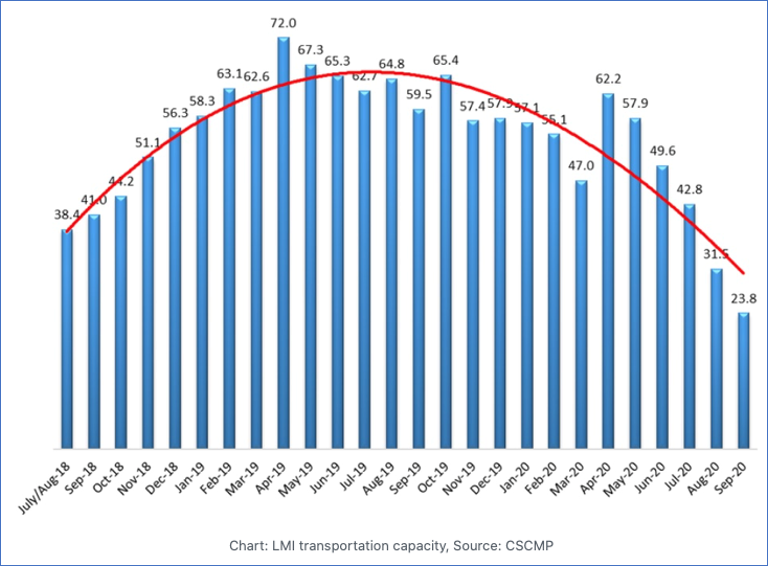

Trailer capacity has contracted at an incredibly quick rate to a new two year low of 23.8.

This has happened earlier in peak season than usual, and at a faster rate of decline.

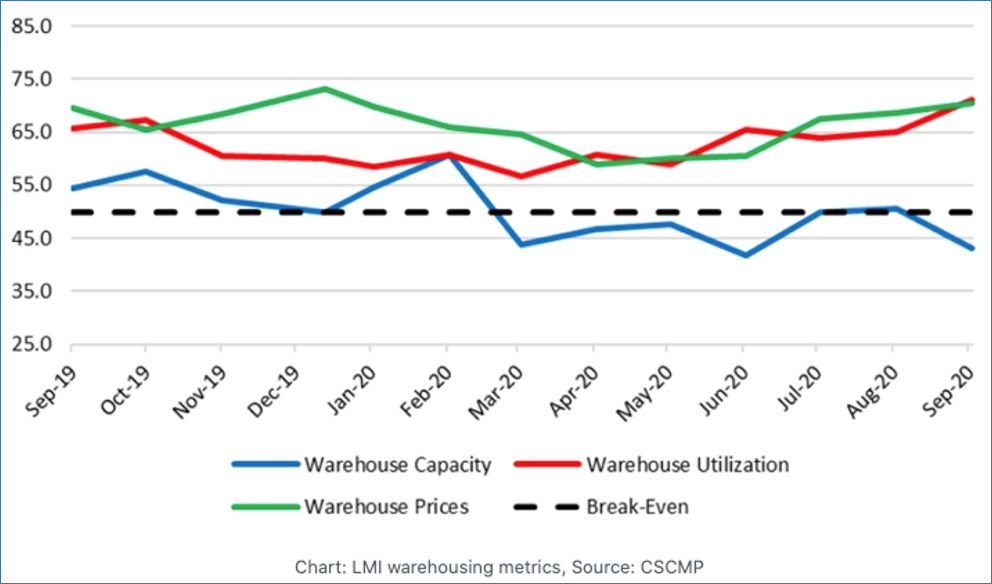

The survey captures the rate of change in activity for key supply chain trends in areas like transportation, inventory and warehousing.

Warehouse capacity and costs continue to increase as overall warehouse capacity begins to contract